The 2024 Cost-of-Living Increase for Social Security benefits is an important development that affects millions of Americans. Social Security benefits are a crucial source of income for retired workers, children, spouses, and disabled individuals. The annual cost-of-living adjustment (COLA) is designed to ensure that these benefits keep pace with inflation and maintain their purchasing power.

In 2023, Social Security recipients saw a significant 8.7% increase in their benefits. However, the 2024 increase is more moderate at 3.2%. This decrease reflects the easing of inflationary pressures as the economy recovers from the pandemic. It may also signal a return to pre-pandemic levels of inflation.

While the 2024 increase is lower than the previous year, it is still above the 20-year average of 2.6%. This means that Social Security recipients can expect their monthly checks to increase by more than $50 starting in January 2024. The average monthly check for a single retired worker will rise to $1,907 in 2024 from $1,848 in 2023. For retired couples, the average monthly benefits will increase to $3,033 in 2024 from $2,939 in 2023.

Understanding the 2024 Cost-of-Living Increase

The 2024 Cost-of-Living Increase is an adjustment made to Social Security benefits to help them keep pace with inflation. It is determined by the Consumer Price Index (CPI), which measures changes in prices for a range of goods and services. The CPI is calculated by the Bureau of Labor Statistics based on the cost of a fixed basket of goods and services. The increase in the CPI from the third quarter of the previous year to the third quarter of the current year is used to calculate the Cost-of-Living Increase for the following year.

The Social Security Act and its Role in the Increase

The Social Security Act plays a crucial role in determining the Cost-of-Living Increase for Social Security benefits. The act was passed in 1935 to provide a safety net for retired workers, disabled individuals, and the dependents of deceased workers. It established the Social Security Administration, which administers the Social Security program and determines benefit amounts.

The act also includes provisions for cost-of-living adjustments to ensure that Social Security benefits keep up with inflation. These adjustments began in 1975 and are based on changes in the Consumer Price Index. The goal is to prevent the erosion of purchasing power for Social Security recipients over time. The 2024 Cost-of-Living Increase of 3.2% reflects the changes in the CPI from the third quarter of 2022 to the third quarter of 2023.

Effective Date of the Increase

The 2024 Cost-of-Living Increase will go into effect for Social Security benefit payments starting in January 2024. This means that Social Security recipients will see an increase in their monthly benefit amounts beginning in January. The exact amount of the increase will depend on individual circumstances and the amount of the benefit they are currently receiving.

The increase in benefits will be reflected in the January payments, which are typically received in the first few days of the month. Social Security recipients can expect to see an increase in their monthly checks and should plan their budgets accordingly. The average monthly Social Security benefit for a single retired worker will rise to $1,907 in 2024, an increase of more than $50 compared to 2023.

It’s important for Social Security recipients to be aware of the effective date of the increase and to plan their finances accordingly. The increase in benefits can provide some relief to individuals and families who rely on Social Security as a vital source of income.

The National Average Wage Index for 2022

The National Average Wage Index for 2022, as determined by the Social Security Administration, is $63,795.13. This index plays a crucial role in determining the cost-of-living adjustment (COLA) for Social Security benefits. The national average wage index is calculated based on the average wages of workers across the country. It provides a basis for determining the maximum amount of earnings subject to Social Security taxes and also affects other program parameters.

How the Index Affects the Cost-of-Living Increase

The national average wage index directly impacts the cost-of-living adjustment (COLA) for Social Security benefits. The COLA is the increase in monthly benefit amounts to help beneficiaries keep up with inflation. The COLA is calculated by comparing the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) in the third quarter of the previous year to the CPI-W in the third quarter of the current year. If there is an increase in the CPI-W, Social Security benefits are adjusted accordingly. The 2024 COLA is 3.2%, which means that Social Security recipients will see an increase in their monthly payments starting in January 2024.

The Role of the Index in Setting Other Program Parameters

The national average wage index not only affects the cost-of-living adjustment (COLA) for Social Security benefits but also plays a role in setting other program parameters. For example, the index is used to determine the Supplemental Security Income (SSI) payment amounts, the maximum Federal Supplemental Security Income (SSI) monthly payment amounts, and the special benefit amount for certain World War II veterans. Additionally, the index is used in the calculation of the student earned income exclusion and the fee for services performed as a representative payee. The national average wage index is an essential factor in determining various aspects of Social Security program parameters.

Key Impacts of the Cost-of-Living Increase

The cost-of-living increase (COLA) for 2024 will have several key impacts on Social Security recipients and the overall economy. One of the primary impacts is the increase in monthly Social Security payments, which will help millions of people keep up with their expenses. The 2024 COLA of 3.2% is above the 2.6% average over the past 20 years, providing beneficiaries with a significant boost in their monthly checks. This increase in income can help alleviate financial stress and provide a higher standard of living for Social Security recipients.

Effect on Social Security Benefits

The cost-of-living increase (COLA) for 2024 will result in an increase in Social Security benefits for recipients. According to the Social Security Administration, on average, Social Security retirement benefits will increase by more than $50 per month starting in January 2024. The average monthly check for a single retired worker will rise to $1,907 in 2024 from $1,848 in 2023. A retired couple receiving benefits, on average, can expect monthly benefits to increase to $3,033 in 2024 from $2,939 in 2023. This increase in benefits will help social security recipients keep pace with rising costs and maintain their standard of living.

Changes to Other Program Amounts

The cost-of-living increase (COLA) for 2024 not only affects Social Security benefits but also leads to changes in other program amounts. For example, the maximum Federal Supplemental Security Income (SSI) monthly payment amounts for 2024 will be $943 for an eligible individual, $1,415 for an eligible individual with an eligible spouse, and $472 for an essential person. These increases in SSI payment amounts will provide additional financial support to low-income individuals and families. Additionally, other program amounts, such as the student earned income exclusion and the fee for services performed as a representative payee, will also be adjusted based on the COLA.

How the Social Security COLA is Calculated

The Social Security cost-of-living adjustment (COLA) is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures changes in the prices of a basket of goods and services typically purchased by urban wage earners and clerical workers. The COLA calculation compares the average CPI-W for the third quarter of the previous year to the average CPI-W for the third quarter of the current year. If there is an increase in the CPI-W, Social Security benefits are adjusted accordingly. The COLA helps ensure that Social Security payments keep pace with inflation and the rising cost of living.

Factors Influencing the Calculation

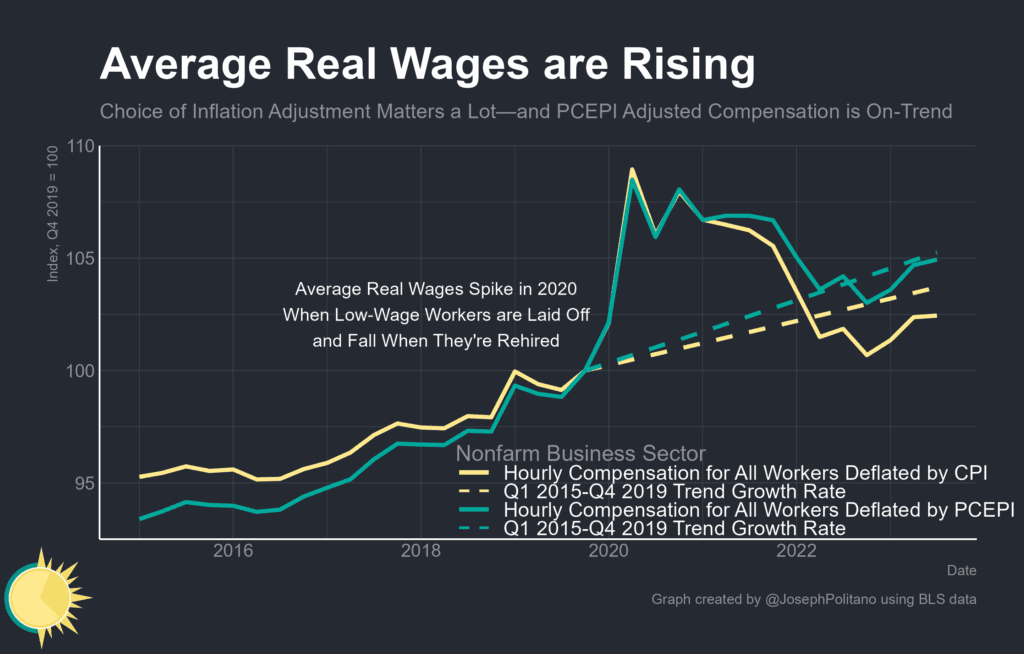

The calculation of the Social Security cost-of-living adjustment (COLA) is influenced by various factors, including the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures changes in the prices of goods and services typically purchased by urban wage earners and clerical workers. Other factors that affect the COLA calculation include economic conditions, employment levels, and wage growth. The COLA aims to keep Social Security benefits in line with the cost of living, ensuring that beneficiaries can maintain their purchasing power over time.

Is the Calculation Fair?

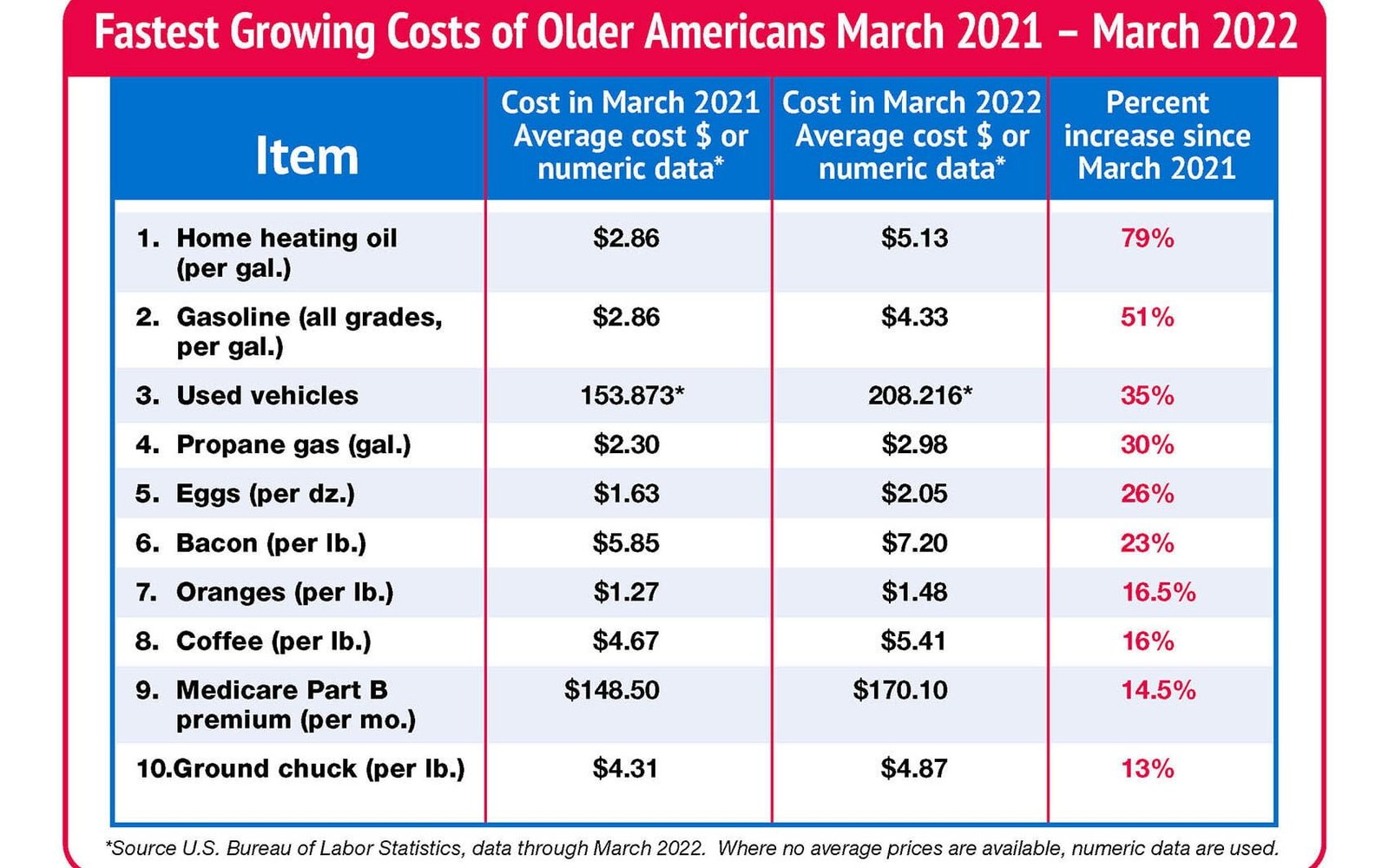

The calculation of the Social Security cost-of-living adjustment (COLA) has been a topic of debate, with some arguing that it does not adequately reflect increases in senior expenses. The use of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) in the COLA calculation has been criticized for not fully capturing the rising costs of essentials, such as healthcare. Some advocacy groups suggest using alternative measures, such as the Consumer Price Index for the Elderly (CPI-E), which focuses on the expenses of Americans aged 62 and older. However, changing the calculation method is a complex issue that requires careful consideration of various factors and potential impacts.

The History of Cost-of-Living Adjustments

The history of cost-of-living adjustments (COLAs) for Social Security benefits dates back to the 1970s. Prior to the implementation of COLAs, Social Security benefits remained stagnant, leading to a decline in purchasing power for beneficiaries. The Social Security Amendments of 1972 introduced the automatic adjustment of benefits based on changes in the Consumer Price Index. Since then, COLAs have been used to ensure that Social Security payments keep pace with inflation and the rising cost of living.

Major Milestones and Changes over Time

Over the years, there have been major milestones and changes in the implementation of cost-of-living adjustments (COLAs) for Social Security benefits. In 1975, the first COLA was implemented, resulting in a 8.0% increase in benefits. Since then, COLAs have been calculated annually based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). However, the specific calculation method and the resulting percentage increase have varied from year to year. The history of COLAs reflects the evolving understanding of inflation and the changing needs of Social Security beneficiaries.

Lessons from Previous Years

Previous years’ cost-of-living adjustments (COLAs) provide valuable insights into the impact of inflation on Social Security benefits. The percentage increase in COLAs varies from year to year, reflecting changes in economic conditions and the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Understanding the patterns and trends in COLAs can help individuals and policymakers anticipate future changes and plan accordingly. It is important for social security recipients to stay informed about COLAs and how they may affect their monthly payments.

Preparing for the 2024 Cost-of-Living Increase

As the 2024 cost-of-living increase (COLA) approaches, it is important for Social Security beneficiaries to prepare and understand the potential impact on their finances. There are several steps individuals can take to prepare for the COLA increase. These include reviewing their Social Security account, calculating their new benefit amount, and considering how the increase may affect their overall retirement savings. It is also important to keep personal information up to date with the Social Security Administration to ensure smooth communication and delivery of benefits.

What You Can Do Now

To prepare for the 2024 cost-of-living increase (COLA), Social Security beneficiaries can take several proactive steps. First, individuals can review their Social Security account to ensure that their benefit amount is accurate and up to date. This can be done online through the Social Security Administration’s website. Second, individuals can calculate their new benefit amount based on the expected COLA increase. This will help individuals plan their budget and make any necessary adjustments. Finally, individuals can consider how the COLA increase may impact their overall retirement savings and financial goals, including factors such as health care costs and other living expenses.

Planning for Future Increases

As Social Security beneficiaries prepare for the 2024 cost-of-living increase (COLA), it is important to consider future COLA increases and plan accordingly. The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of living over time. Planning for future COLA increases involves anticipating changes in the CPI-W and considering how they may affect Social Security payments. It is also important to consider other factors, such as health care costs and overall retirement savings, when planning for future COLA increases.

Conclusion

In conclusion, the 2024 Cost-of-Living Increase brings both opportunities and challenges for individuals relying on Social Security benefits. Understanding the key highlights and factors influencing the increase is crucial in planning for the future. By staying informed about the effective date, the National Average Wage Index, and how the increase affects Social Security benefits and other program amounts, individuals can make informed decisions. It’s also important to learn from the history of cost-of-living adjustments and the lessons from previous years. As we prepare for the increase, it’s recommended to take proactive steps such as reviewing your financial situation, exploring available resources, and planning for future increases. If you have any questions or insights regarding the 2024 Cost-of-Living Increase, please feel free to comment below and share your thoughts.

Frequently Asked Questions

When will the Cost-of-Living Increase Take Effect?

The cost-of-living increase will take effect in January 2024. This annual adjustment aims to counteract the effects of inflation on Social Security benefits and other programs. The effective date remains consistent each year, providing predictability for beneficiaries.

How Will I Know If My Benefits Have Increased?

You will receive a notice in December, stating your new benefit amount for the upcoming year. The Social Security Administration also provides an online tool to check your benefit increase. Keep an eye on your mailbox and log in to your account for updates.

How much will my Social Security payment be with the 2024 COLA increase?

Your Social Security payment will increase in 2024 due to the Cost-of-Living Adjustment (COLA). The exact amount of the increase depends on your current benefit amount and the percentage of the COLA for 2024. Look for official announcements from the Social Security Administration for specific details.

How does 2024’s COLA compare with prior years?

The 2024 Cost-of-Living Adjustment (COLA) will be compared to prior years based on economic indicators and inflation rates. Understanding these comparisons can provide insight into the impact of COLA on Social Security benefits and other program amounts. The history of COLA adjustments will also offer valuable context.

How is the cost-of-living adjustment calculated?

The cost-of-living adjustment is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers. The average CPI-W for the third quarter of the current year is compared to the third quarter of the previous year to determine the percentage increase in the cost of living.

What factors are projected to contribute to the cost of living increase in 2024?

The cost of living increase in 2024 is projected to be influenced by various factors, including inflation rates, wage growth, and consumer spending patterns. Economic indicators and government policies will also play a significant role in determining the adjustment.

How much is the cost of living expected to increase in 2024?

The cost of living is expected to increase by 4.7% in 2024, as per the latest projections. This increase is based on the rising inflation rates and other economic factors. Understanding the projected increase can help individuals and organizations better prepare for potential financial adjustments.

Will the cost of living increase affect all regions equally?

The cost of living increase may not affect all regions equally due to varying economic conditions, housing costs, and regional price differences. Factors such as urban versus rural living and geographic location play a role in how the increase impacts different regions.

What impact will the cost of living increase have on retirement savings and Social Security benefits?

The cost of living increase can positively impact retirement savings and social security benefits, providing recipients with higher payouts to keep up with rising expenses. However, it’s important to consider potential inflationary effects and adjustments to investment strategies.

How can individuals prepare for the cost of living increase in 2024?

Individuals can prepare for the 2024 cost-of-living increase by evaluating their current expenses, creating a budget, and exploring ways to increase their income. They can also consider adjusting their investments and seeking financial advice to navigate the potential impact on their finances.

What industries or sectors will be most affected by the cost of living increase in 2024?

Industries heavily reliant on low-wage workers, such as retail, hospitality, and healthcare, will experience significant impacts from the 2024 cost-of-living increase. Other sectors affected include transportation, manufacturing, and food services. The adjustment will have far-reaching effects across various industries.

Are there any government programs or policies that can help mitigate the effects of a cost of living increase?

There are various government programs and policies designed to mitigate the effects of a cost of living increase. These include assistance programs for low-income individuals, subsidized housing initiatives, and food assistance programs such as SNAP. Additionally, there are tax credits and healthcare subsidies available to ease the financial burden.

How does the projected cost of living increase compare to previous years?

The projected cost of living increase is higher in 2024 compared to previous years. This increase reflects the rising inflation and its impact on everyday expenses. Understanding these changes can help individuals better prepare for the financial adjustments ahead.